The acquiring bank does more than just process transactions. They review merchants before approving them, monitor transaction patterns for suspicious activity, and ensure businesses comply with Payment Card Industry Data Security Standards (PCI DSS). This oversight protects both you and the payment system from fraud and security problems.

Key components of card acquiring

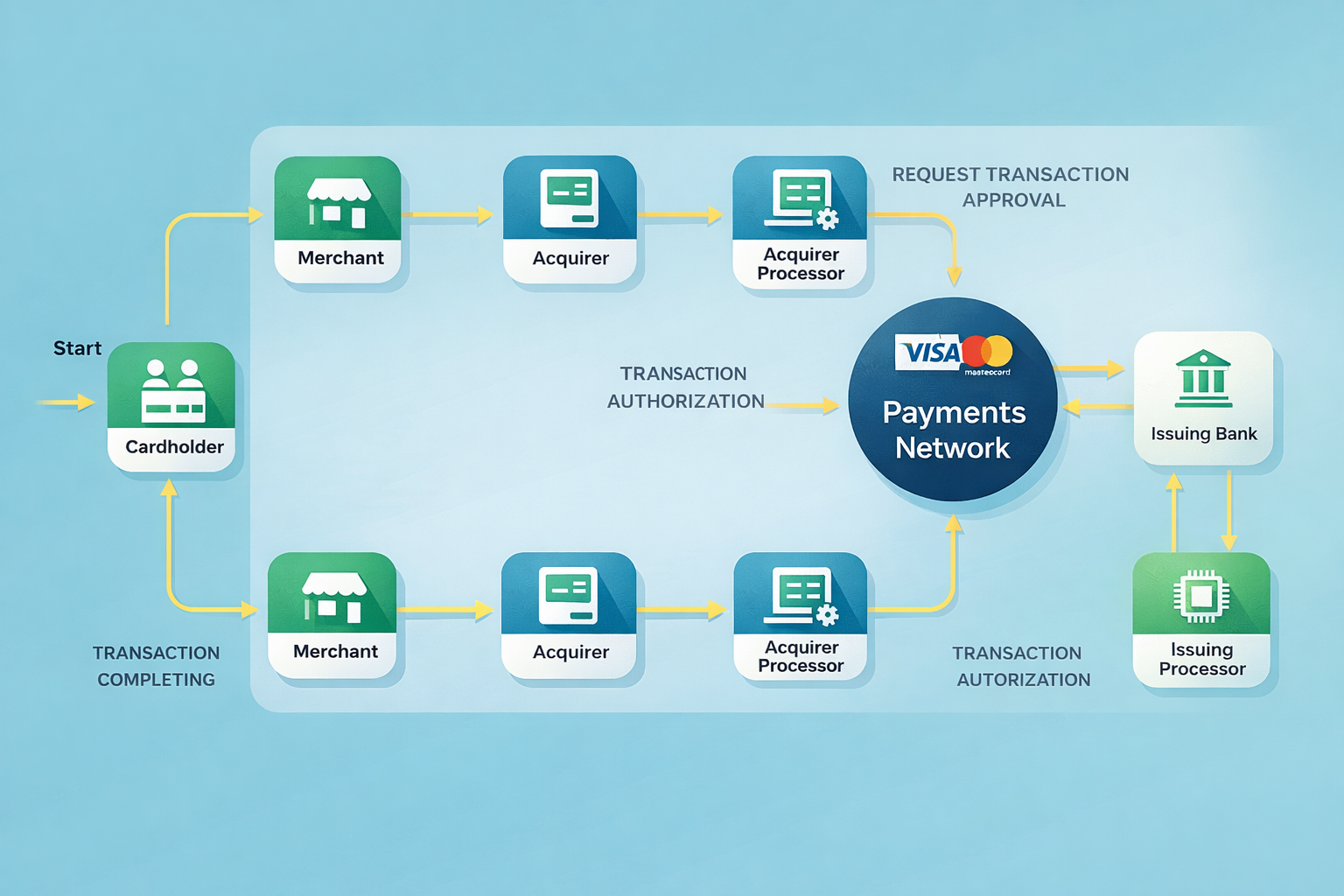

The card acquiring ecosystem involves several important players, each with specific roles:

Well, everyone who is interested in payment and if u are here and reading it i assume the most interested for you is Costs/Tearms and Approval.

Starting with Costs we have to mention it for all the industries. Depending of the country and their ING policies fees are defering.

Approximate canculation:

Intercharge fees + Scheme + Aquirer markup

Intercharge fees (0.20% (debit) / 0.30% (credit) + Scheme (~0.02% to 0.15% of the transaction value) + Acquirer markup (~0.30%–1.50% of transaction value).

Terms and Approval Process for Merchant Accounts with Acquiring Banks

Before a business can start accepting card payments, acquiring banks perform a careful review to ensure the merchant is trustworthy, compliant, and capable of handling secure transactions. Understanding this process is essential for businesses looking to integrate card payments smoothly.

1. Merchant Application

The first step in acquiring bank approval is the merchant application. During this stage, the business provides the acquiring bank with key information, including:

This step allows the bank to verify the legitimacy of the business and gather the information needed for risk assessment and setup.

2. Risk Assessment

After submitting the application, the acquiring bank conducts a risk assessment. This evaluation includes:

The goal of this assessment is to protect both the payment system and the merchant from potential financial and security risks.

3. Approval and Contract

Once the risk assessment is completed and the merchant is deemed eligible, the bank issues an approval and provides a contract outlining:

This formal agreement establishes the framework for the merchant’s card payment processing relationship with the acquiring bank.

4. Integration

After approval, the merchant must integrate their payment systems with the acquiring bank. This can involve:

The integration ensures that transactions are processed securely and efficiently, and that funds are accurately transferred to the merchant’s account.

5. Key Terms to Consider

When negotiating or reviewing a merchant account contract, consider the following key terms: